Collection of Careshield life medisave ~ Pioneers also receive 250 - 900 a year in MediSave top-ups depending on year of birth for life which can be used to pay for their MediShield Life premiums. In order to sufficiently cover this expense one can enhance their Careshield Life with supplement plans to increase the potential payout.

as we know it recently is being searched by users around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this article I will talk about about Careshield Life Medisave CareShield Life will be replacing the existing ElderShield scheme whereas MediSave Care introduces a new option for individuals to use their MediSave balance.

Careshield life medisave

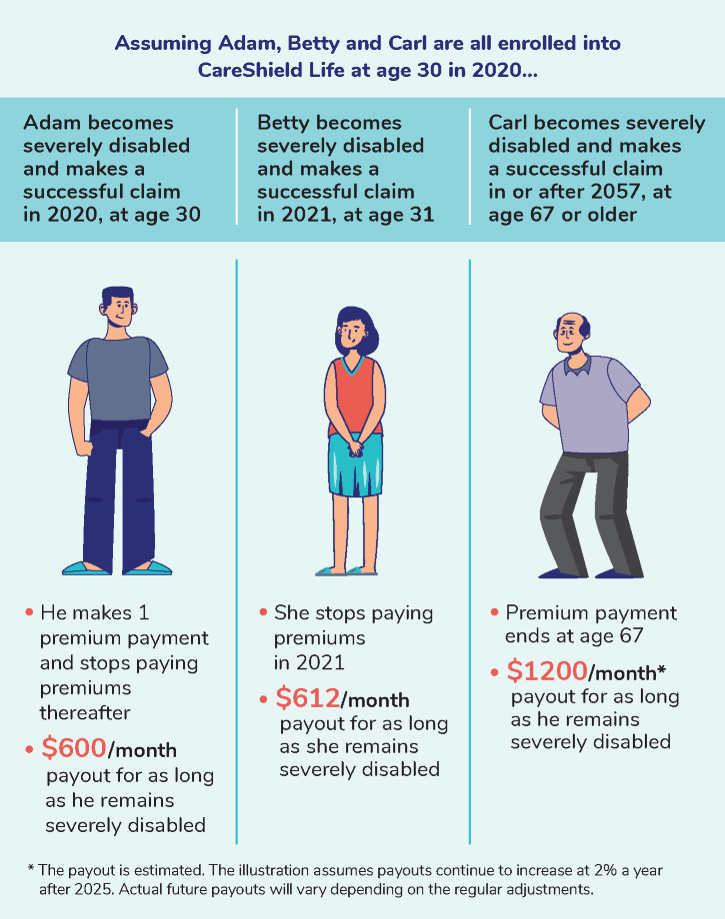

Collection of Careshield life medisave ~ CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. ElderShield premiums are kept affordable to ensure that all Singaporeans have basic financial protection in the event of a severe disability in old age. ElderShield premiums are kept affordable to ensure that all Singaporeans have basic financial protection in the event of a severe disability in old age. ElderShield premiums are kept affordable to ensure that all Singaporeans have basic financial protection in the event of a severe disability in old age. ElderShield premiums are kept affordable to ensure that all Singaporeans have basic financial protection in the event of a severe disability in old age. This benefit is available for life. This benefit is available for life. This benefit is available for life. This benefit is available for life.

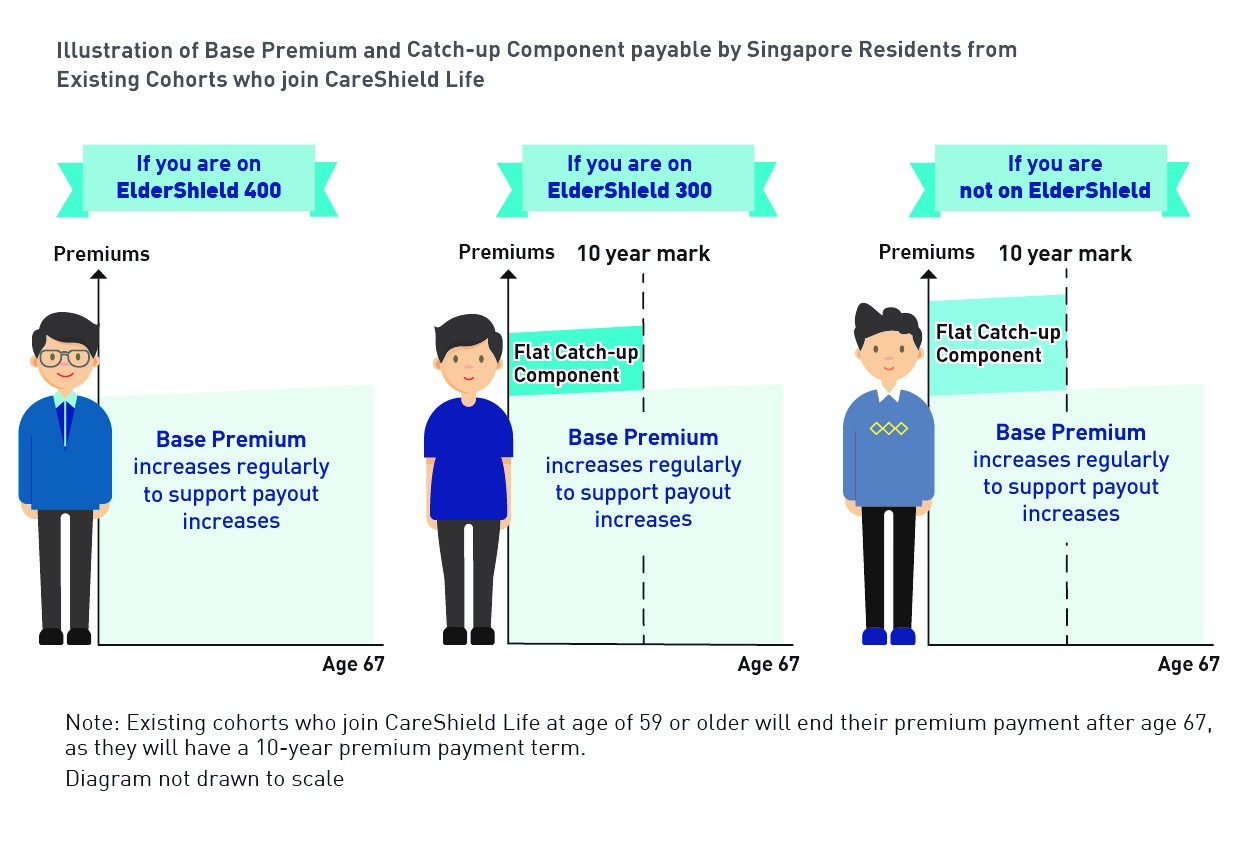

Those who are still unable to afford their MediShield Life andor CareShield Life premiums even after Government subsidies and MediSave and have limited family support may apply for Additional Premium Support. Those who are still unable to afford their MediShield Life andor CareShield Life premiums even after Government subsidies and MediSave and have limited family support may apply for Additional Premium Support. Those who are still unable to afford their MediShield Life andor CareShield Life premiums even after Government subsidies and MediSave and have limited family support may apply for Additional Premium Support. Those who are still unable to afford their MediShield Life andor CareShield Life premiums even after Government subsidies and MediSave and have limited family support may apply for Additional Premium Support. ElderShield 300 or ElderShield 400 or Supplement you are covered under please contact your Insurer. ElderShield 300 or ElderShield 400 or Supplement you are covered under please contact your Insurer. ElderShield 300 or ElderShield 400 or Supplement you are covered under please contact your Insurer. ElderShield 300 or ElderShield 400 or Supplement you are covered under please contact your Insurer. It provides payouts of 300month or 400month for 5 or 6 years. It provides payouts of 300month or 400month for 5 or 6 years. It provides payouts of 300month or 400month for 5 or 6 years. It provides payouts of 300month or 400month for 5 or 6 years.

Coverage is worldwide and claims can be made and payout received regardless of where you are residing. Coverage is worldwide and claims can be made and payout received regardless of where you are residing. Coverage is worldwide and claims can be made and payout received regardless of where you are residing. Coverage is worldwide and claims can be made and payout received regardless of where you are residing. They can withdraw up to 2400year or 200month as cash to supplement their long-term care needs. They can withdraw up to 2400year or 200month as cash to supplement their long-term care needs. They can withdraw up to 2400year or 200month as cash to supplement their long-term care needs. They can withdraw up to 2400year or 200month as cash to supplement their long-term care needs. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave.

The premiums are based on the age at which you join the scheme and payable until the policy anniversary after your 65th birthday. The premiums are based on the age at which you join the scheme and payable until the policy anniversary after your 65th birthday. The premiums are based on the age at which you join the scheme and payable until the policy anniversary after your 65th birthday. The premiums are based on the age at which you join the scheme and payable until the policy anniversary after your 65th birthday. The plan offers a monthly payout in the event of severe disability providing basic financial support for. The plan offers a monthly payout in the event of severe disability providing basic financial support for. The plan offers a monthly payout in the event of severe disability providing basic financial support for. The plan offers a monthly payout in the event of severe disability providing basic financial support for. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime.

Premiums can be fully paid by MediSave. Premiums can be fully paid by MediSave. Premiums can be fully paid by MediSave. Premiums can be fully paid by MediSave. The Government will send these members an application form to invite them to apply for Additional Premium Support. The Government will send these members an application form to invite them to apply for Additional Premium Support. The Government will send these members an application form to invite them to apply for Additional Premium Support. The Government will send these members an application form to invite them to apply for Additional Premium Support. CareShield Life the new national long-term care insurance scheme and MediSave Care which allows cash withdrawals from MediSave accounts for long-term care needs will be launched on 1 October 2020. CareShield Life the new national long-term care insurance scheme and MediSave Care which allows cash withdrawals from MediSave accounts for long-term care needs will be launched on 1 October 2020. CareShield Life the new national long-term care insurance scheme and MediSave Care which allows cash withdrawals from MediSave accounts for long-term care needs will be launched on 1 October 2020. CareShield Life the new national long-term care insurance scheme and MediSave Care which allows cash withdrawals from MediSave accounts for long-term care needs will be launched on 1 October 2020.

Auto Enroll into careshield life from 30-40 yo Born Between. Auto Enroll into careshield life from 30-40 yo Born Between. Auto Enroll into careshield life from 30-40 yo Born Between. Auto Enroll into careshield life from 30-40 yo Born Between. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. CareShield Life and MediSave Care to launch in October CareShield Life will provide higher payouts for life compared to ElderShield where payouts are fixed at S300 or S400 a month and capped. CareShield Life and MediSave Care to launch in October CareShield Life will provide higher payouts for life compared to ElderShield where payouts are fixed at S300 or S400 a month and capped. CareShield Life and MediSave Care to launch in October CareShield Life will provide higher payouts for life compared to ElderShield where payouts are fixed at S300 or S400 a month and capped. CareShield Life and MediSave Care to launch in October CareShield Life will provide higher payouts for life compared to ElderShield where payouts are fixed at S300 or S400 a month and capped.

The scheme will be closed from end-2021 onwards once CareShield Life is made available to all Singaporeans aged 30 and above. The scheme will be closed from end-2021 onwards once CareShield Life is made available to all Singaporeans aged 30 and above. The scheme will be closed from end-2021 onwards once CareShield Life is made available to all Singaporeans aged 30 and above. The scheme will be closed from end-2021 onwards once CareShield Life is made available to all Singaporeans aged 30 and above. A bigger better Eldershield. A bigger better Eldershield. A bigger better Eldershield. A bigger better Eldershield. CareShield Life premiums are payable annually and it will be automatically deducted from your MediSave Account within 1 month from your policy anniversary. CareShield Life premiums are payable annually and it will be automatically deducted from your MediSave Account within 1 month from your policy anniversary. CareShield Life premiums are payable annually and it will be automatically deducted from your MediSave Account within 1 month from your policy anniversary. CareShield Life premiums are payable annually and it will be automatically deducted from your MediSave Account within 1 month from your policy anniversary.

You can write to us using the Feedback Form below. You can write to us using the Feedback Form below. You can write to us using the Feedback Form below. You can write to us using the Feedback Form below. These schemes as well as ElderFund launched in January 2020 are part of the package of long-term care financing measures which were announced in 2019. These schemes as well as ElderFund launched in January 2020 are part of the package of long-term care financing measures which were announced in 2019. These schemes as well as ElderFund launched in January 2020 are part of the package of long-term care financing measures which were announced in 2019. These schemes as well as ElderFund launched in January 2020 are part of the package of long-term care financing measures which were announced in 2019. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime.

Age 67 or later as per Singapores re-employment age. Age 67 or later as per Singapores re-employment age. Age 67 or later as per Singapores re-employment age. Age 67 or later as per Singapores re-employment age. Heres a detailed breakdown of these two new schemes. Heres a detailed breakdown of these two new schemes. Heres a detailed breakdown of these two new schemes. Heres a detailed breakdown of these two new schemes. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020.

Unknown as premiums are not fixed. Unknown as premiums are not fixed. Unknown as premiums are not fixed. Unknown as premiums are not fixed. It is literally true in. It is literally true in. It is literally true in. It is literally true in. Long-term disability support scheme CareShield Life will soon be open to. Long-term disability support scheme CareShield Life will soon be open to. Long-term disability support scheme CareShield Life will soon be open to. Long-term disability support scheme CareShield Life will soon be open to.

In order to sufficiently cover this expense one can enhance their Careshield Life with supplement plans to increase the potential payout. In order to sufficiently cover this expense one can enhance their Careshield Life with supplement plans to increase the potential payout. In order to sufficiently cover this expense one can enhance their Careshield Life with supplement plans to increase the potential payout. In order to sufficiently cover this expense one can enhance their Careshield Life with supplement plans to increase the potential payout. A long-term care insurance scheme targeted at severe disability. A long-term care insurance scheme targeted at severe disability. A long-term care insurance scheme targeted at severe disability. A long-term care insurance scheme targeted at severe disability. CareShield Life ElderShield MediShield Life CPF LIFE CHAS HCG PioneerDAS ElderFund and IDAPE are schemes that help Singaporeans with different types of healthcare and retirement. CareShield Life ElderShield MediShield Life CPF LIFE CHAS HCG PioneerDAS ElderFund and IDAPE are schemes that help Singaporeans with different types of healthcare and retirement. CareShield Life ElderShield MediShield Life CPF LIFE CHAS HCG PioneerDAS ElderFund and IDAPE are schemes that help Singaporeans with different types of healthcare and retirement. CareShield Life ElderShield MediShield Life CPF LIFE CHAS HCG PioneerDAS ElderFund and IDAPE are schemes that help Singaporeans with different types of healthcare and retirement.

Click here for the list of assessors. Click here for the list of assessors. Click here for the list of assessors. Click here for the list of assessors. With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave.

SINGAPORE Long-term care support schemes CareShield Life and MediSave Care will be launched on Oct 1 the Ministry of Health MOH announced on. SINGAPORE Long-term care support schemes CareShield Life and MediSave Care will be launched on Oct 1 the Ministry of Health MOH announced on. SINGAPORE Long-term care support schemes CareShield Life and MediSave Care will be launched on Oct 1 the Ministry of Health MOH announced on. SINGAPORE Long-term care support schemes CareShield Life and MediSave Care will be launched on Oct 1 the Ministry of Health MOH announced on. To qualify for payout. To qualify for payout. To qualify for payout. To qualify for payout. However CareShield Life and MediSave Care will share the same disability assessment so that the costs of the first disability assessment will be waived and subsequent assessments for CareShield Life insureds will be fully reimbursed if the application outcome is successful. However CareShield Life and MediSave Care will share the same disability assessment so that the costs of the first disability assessment will be waived and subsequent assessments for CareShield Life insureds will be fully reimbursed if the application outcome is successful. However CareShield Life and MediSave Care will share the same disability assessment so that the costs of the first disability assessment will be waived and subsequent assessments for CareShield Life insureds will be fully reimbursed if the application outcome is successful. However CareShield Life and MediSave Care will share the same disability assessment so that the costs of the first disability assessment will be waived and subsequent assessments for CareShield Life insureds will be fully reimbursed if the application outcome is successful.

3625 To ask the Minister for Health whether the ongoing COVID-19 pandemic will affect the implementation dates of i CareShield Life and ii MediSave Care. 3625 To ask the Minister for Health whether the ongoing COVID-19 pandemic will affect the implementation dates of i CareShield Life and ii MediSave Care. 3625 To ask the Minister for Health whether the ongoing COVID-19 pandemic will affect the implementation dates of i CareShield Life and ii MediSave Care. 3625 To ask the Minister for Health whether the ongoing COVID-19 pandemic will affect the implementation dates of i CareShield Life and ii MediSave Care. Older Pioneer Generation Seniors who have serious pre-existing conditions also receive additional MediSave top-ups of 50-200 annually from 2021 to 2025 which can be used to pay for their MediShield. Older Pioneer Generation Seniors who have serious pre-existing conditions also receive additional MediSave top-ups of 50-200 annually from 2021 to 2025 which can be used to pay for their MediShield. Older Pioneer Generation Seniors who have serious pre-existing conditions also receive additional MediSave top-ups of 50-200 annually from 2021 to 2025 which can be used to pay for their MediShield. Older Pioneer Generation Seniors who have serious pre-existing conditions also receive additional MediSave top-ups of 50-200 annually from 2021 to 2025 which can be used to pay for their MediShield. However a minimum of 5000 will need to be set aside in MediSave to ensure there is sufficient MediSave for other medical expenses such as MediShield Life premiums or hospitalisations and cannot be withdrawn. However a minimum of 5000 will need to be set aside in MediSave to ensure there is sufficient MediSave for other medical expenses such as MediShield Life premiums or hospitalisations and cannot be withdrawn. However a minimum of 5000 will need to be set aside in MediSave to ensure there is sufficient MediSave for other medical expenses such as MediShield Life premiums or hospitalisations and cannot be withdrawn. However a minimum of 5000 will need to be set aside in MediSave to ensure there is sufficient MediSave for other medical expenses such as MediShield Life premiums or hospitalisations and cannot be withdrawn.

CareShield Life and MediSave Care. CareShield Life and MediSave Care. CareShield Life and MediSave Care. CareShield Life and MediSave Care. Benefits Auto Enroll into careshield life from 30-40 yo Born Between 1980 -. Benefits Auto Enroll into careshield life from 30-40 yo Born Between 1980 -. Benefits Auto Enroll into careshield life from 30-40 yo Born Between 1980 -. Benefits Auto Enroll into careshield life from 30-40 yo Born Between 1980 -. Medisave and Medishield Life can be used together to pay hospitalisation bills The difference is that Medishield life is designed to help pay larger B2C hospitalisation bills while Medisave for smaller ones. Medisave and Medishield Life can be used together to pay hospitalisation bills The difference is that Medishield life is designed to help pay larger B2C hospitalisation bills while Medisave for smaller ones. Medisave and Medishield Life can be used together to pay hospitalisation bills The difference is that Medishield life is designed to help pay larger B2C hospitalisation bills while Medisave for smaller ones. Medisave and Medishield Life can be used together to pay hospitalisation bills The difference is that Medishield life is designed to help pay larger B2C hospitalisation bills while Medisave for smaller ones.

This benefit is available for life data-reactid22Come 1 October well see the launch of two new healthcare schemes CareShield Life and MediSave Care designed to provide monthly cash payouts to Singaporeans aged 30 and above who suffer from severe disability or as long as they require long-term care. This benefit is available for life data-reactid22Come 1 October well see the launch of two new healthcare schemes CareShield Life and MediSave Care designed to provide monthly cash payouts to Singaporeans aged 30 and above who suffer from severe disability or as long as they require long-term care. This benefit is available for life data-reactid22Come 1 October well see the launch of two new healthcare schemes CareShield Life and MediSave Care designed to provide monthly cash payouts to Singaporeans aged 30 and above who suffer from severe disability or as long as they require long-term care. This benefit is available for life data-reactid22Come 1 October well see the launch of two new healthcare schemes CareShield Life and MediSave Care designed to provide monthly cash payouts to Singaporeans aged 30 and above who suffer from severe disability or as long as they require long-term care. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year.

The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year. Of course you still can reap the benefits of Medishield life whichever ward class AB1 you choose to stay in or in a private hospital. Of course you still can reap the benefits of Medishield life whichever ward class AB1 you choose to stay in or in a private hospital. Of course you still can reap the benefits of Medishield life whichever ward class AB1 you choose to stay in or in a private hospital. Of course you still can reap the benefits of Medishield life whichever ward class AB1 you choose to stay in or in a private hospital. Increase your payout from 600 to 2500 per month without cash top-up. Increase your payout from 600 to 2500 per month without cash top-up. Increase your payout from 600 to 2500 per month without cash top-up. Increase your payout from 600 to 2500 per month without cash top-up.

This figure is pretty close to the average. This figure is pretty close to the average. This figure is pretty close to the average. This figure is pretty close to the average. End of premium payment. End of premium payment. End of premium payment. End of premium payment. The benefits are just pegged. The benefits are just pegged. The benefits are just pegged. The benefits are just pegged.

From 206 for men and 253 for women and will increase over time Estimated values Number of payments. From 206 for men and 253 for women and will increase over time Estimated values Number of payments. From 206 for men and 253 for women and will increase over time Estimated values Number of payments. From 206 for men and 253 for women and will increase over time Estimated values Number of payments. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration. Calling CareShield Life a bigger and better ElderShield isnt just hyperbole. Calling CareShield Life a bigger and better ElderShield isnt just hyperbole. Calling CareShield Life a bigger and better ElderShield isnt just hyperbole. Calling CareShield Life a bigger and better ElderShield isnt just hyperbole.

1 CareShield Life is a new long-term care insurance scheme and MediSave Care provides cash withdrawals for long-term care needs. 1 CareShield Life is a new long-term care insurance scheme and MediSave Care provides cash withdrawals for long-term care needs. 1 CareShield Life is a new long-term care insurance scheme and MediSave Care provides cash withdrawals for long-term care needs. 1 CareShield Life is a new long-term care insurance scheme and MediSave Care provides cash withdrawals for long-term care needs. You can use the CareShield Life Premium Checker to check how much exactly are your premiums. You can use the CareShield Life Premium Checker to check how much exactly are your premiums. You can use the CareShield Life Premium Checker to check how much exactly are your premiums. You can use the CareShield Life Premium Checker to check how much exactly are your premiums.

Born In 1979 Or Earlier

Source Image @ www.careshieldlife.gov.sg

Careshield life medisave | Born In 1979 Or Earlier

Collection of Careshield life medisave ~ CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. CareShield Life was launched on 1 October 2020 for all Singapore Citizens or Permanent Residents born in 1980 or later. ElderShield premiums are kept affordable to ensure that all Singaporeans have basic financial protection in the event of a severe disability in old age. ElderShield premiums are kept affordable to ensure that all Singaporeans have basic financial protection in the event of a severe disability in old age. ElderShield premiums are kept affordable to ensure that all Singaporeans have basic financial protection in the event of a severe disability in old age. This benefit is available for life. This benefit is available for life. This benefit is available for life.

Those who are still unable to afford their MediShield Life andor CareShield Life premiums even after Government subsidies and MediSave and have limited family support may apply for Additional Premium Support. Those who are still unable to afford their MediShield Life andor CareShield Life premiums even after Government subsidies and MediSave and have limited family support may apply for Additional Premium Support. Those who are still unable to afford their MediShield Life andor CareShield Life premiums even after Government subsidies and MediSave and have limited family support may apply for Additional Premium Support. ElderShield 300 or ElderShield 400 or Supplement you are covered under please contact your Insurer. ElderShield 300 or ElderShield 400 or Supplement you are covered under please contact your Insurer. ElderShield 300 or ElderShield 400 or Supplement you are covered under please contact your Insurer. It provides payouts of 300month or 400month for 5 or 6 years. It provides payouts of 300month or 400month for 5 or 6 years. It provides payouts of 300month or 400month for 5 or 6 years.

Coverage is worldwide and claims can be made and payout received regardless of where you are residing. Coverage is worldwide and claims can be made and payout received regardless of where you are residing. Coverage is worldwide and claims can be made and payout received regardless of where you are residing. They can withdraw up to 2400year or 200month as cash to supplement their long-term care needs. They can withdraw up to 2400year or 200month as cash to supplement their long-term care needs. They can withdraw up to 2400year or 200month as cash to supplement their long-term care needs. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave.

The premiums are based on the age at which you join the scheme and payable until the policy anniversary after your 65th birthday. The premiums are based on the age at which you join the scheme and payable until the policy anniversary after your 65th birthday. The premiums are based on the age at which you join the scheme and payable until the policy anniversary after your 65th birthday. The plan offers a monthly payout in the event of severe disability providing basic financial support for. The plan offers a monthly payout in the event of severe disability providing basic financial support for. The plan offers a monthly payout in the event of severe disability providing basic financial support for. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime.

Premiums can be fully paid by MediSave. Premiums can be fully paid by MediSave. Premiums can be fully paid by MediSave. The Government will send these members an application form to invite them to apply for Additional Premium Support. The Government will send these members an application form to invite them to apply for Additional Premium Support. The Government will send these members an application form to invite them to apply for Additional Premium Support. CareShield Life the new national long-term care insurance scheme and MediSave Care which allows cash withdrawals from MediSave accounts for long-term care needs will be launched on 1 October 2020. CareShield Life the new national long-term care insurance scheme and MediSave Care which allows cash withdrawals from MediSave accounts for long-term care needs will be launched on 1 October 2020. CareShield Life the new national long-term care insurance scheme and MediSave Care which allows cash withdrawals from MediSave accounts for long-term care needs will be launched on 1 October 2020.

Auto Enroll into careshield life from 30-40 yo Born Between. Auto Enroll into careshield life from 30-40 yo Born Between. Auto Enroll into careshield life from 30-40 yo Born Between. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. Click the following links to find out more about CareShield Life features and how the Government will ensure that CareShield Life premiums are affordable for you. CareShield Life and MediSave Care to launch in October CareShield Life will provide higher payouts for life compared to ElderShield where payouts are fixed at S300 or S400 a month and capped. CareShield Life and MediSave Care to launch in October CareShield Life will provide higher payouts for life compared to ElderShield where payouts are fixed at S300 or S400 a month and capped. CareShield Life and MediSave Care to launch in October CareShield Life will provide higher payouts for life compared to ElderShield where payouts are fixed at S300 or S400 a month and capped.

The scheme will be closed from end-2021 onwards once CareShield Life is made available to all Singaporeans aged 30 and above. The scheme will be closed from end-2021 onwards once CareShield Life is made available to all Singaporeans aged 30 and above. The scheme will be closed from end-2021 onwards once CareShield Life is made available to all Singaporeans aged 30 and above. A bigger better Eldershield. A bigger better Eldershield. A bigger better Eldershield. CareShield Life premiums are payable annually and it will be automatically deducted from your MediSave Account within 1 month from your policy anniversary. CareShield Life premiums are payable annually and it will be automatically deducted from your MediSave Account within 1 month from your policy anniversary. CareShield Life premiums are payable annually and it will be automatically deducted from your MediSave Account within 1 month from your policy anniversary.

You can write to us using the Feedback Form below. You can write to us using the Feedback Form below. You can write to us using the Feedback Form below. These schemes as well as ElderFund launched in January 2020 are part of the package of long-term care financing measures which were announced in 2019. These schemes as well as ElderFund launched in January 2020 are part of the package of long-term care financing measures which were announced in 2019. These schemes as well as ElderFund launched in January 2020 are part of the package of long-term care financing measures which were announced in 2019. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime. The premiums for CareShield life are fully payable by MediSave with premiums payable until age 67 while the coverage and benefit payouts are for a lifetime.

Age 67 or later as per Singapores re-employment age. Age 67 or later as per Singapores re-employment age. Age 67 or later as per Singapores re-employment age. Heres a detailed breakdown of these two new schemes. Heres a detailed breakdown of these two new schemes. Heres a detailed breakdown of these two new schemes. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020.

Unknown as premiums are not fixed. Unknown as premiums are not fixed. Unknown as premiums are not fixed. It is literally true in. It is literally true in. It is literally true in. Long-term disability support scheme CareShield Life will soon be open to. Long-term disability support scheme CareShield Life will soon be open to. Long-term disability support scheme CareShield Life will soon be open to.

In order to sufficiently cover this expense one can enhance their Careshield Life with supplement plans to increase the potential payout. In order to sufficiently cover this expense one can enhance their Careshield Life with supplement plans to increase the potential payout. In order to sufficiently cover this expense one can enhance their Careshield Life with supplement plans to increase the potential payout. A long-term care insurance scheme targeted at severe disability. A long-term care insurance scheme targeted at severe disability. A long-term care insurance scheme targeted at severe disability. CareShield Life ElderShield MediShield Life CPF LIFE CHAS HCG PioneerDAS ElderFund and IDAPE are schemes that help Singaporeans with different types of healthcare and retirement. CareShield Life ElderShield MediShield Life CPF LIFE CHAS HCG PioneerDAS ElderFund and IDAPE are schemes that help Singaporeans with different types of healthcare and retirement. CareShield Life ElderShield MediShield Life CPF LIFE CHAS HCG PioneerDAS ElderFund and IDAPE are schemes that help Singaporeans with different types of healthcare and retirement.

Click here for the list of assessors. Click here for the list of assessors. Click here for the list of assessors. With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. With the new implementation of CareShield Life the monthly payout will be 600. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave.

SINGAPORE Long-term care support schemes CareShield Life and MediSave Care will be launched on Oct 1 the Ministry of Health MOH announced on. SINGAPORE Long-term care support schemes CareShield Life and MediSave Care will be launched on Oct 1 the Ministry of Health MOH announced on. SINGAPORE Long-term care support schemes CareShield Life and MediSave Care will be launched on Oct 1 the Ministry of Health MOH announced on. To qualify for payout. To qualify for payout. To qualify for payout. However CareShield Life and MediSave Care will share the same disability assessment so that the costs of the first disability assessment will be waived and subsequent assessments for CareShield Life insureds will be fully reimbursed if the application outcome is successful. However CareShield Life and MediSave Care will share the same disability assessment so that the costs of the first disability assessment will be waived and subsequent assessments for CareShield Life insureds will be fully reimbursed if the application outcome is successful. However CareShield Life and MediSave Care will share the same disability assessment so that the costs of the first disability assessment will be waived and subsequent assessments for CareShield Life insureds will be fully reimbursed if the application outcome is successful.

3625 To ask the Minister for Health whether the ongoing COVID-19 pandemic will affect the implementation dates of i CareShield Life and ii MediSave Care. 3625 To ask the Minister for Health whether the ongoing COVID-19 pandemic will affect the implementation dates of i CareShield Life and ii MediSave Care. 3625 To ask the Minister for Health whether the ongoing COVID-19 pandemic will affect the implementation dates of i CareShield Life and ii MediSave Care. Older Pioneer Generation Seniors who have serious pre-existing conditions also receive additional MediSave top-ups of 50-200 annually from 2021 to 2025 which can be used to pay for their MediShield. Older Pioneer Generation Seniors who have serious pre-existing conditions also receive additional MediSave top-ups of 50-200 annually from 2021 to 2025 which can be used to pay for their MediShield. Older Pioneer Generation Seniors who have serious pre-existing conditions also receive additional MediSave top-ups of 50-200 annually from 2021 to 2025 which can be used to pay for their MediShield. However a minimum of 5000 will need to be set aside in MediSave to ensure there is sufficient MediSave for other medical expenses such as MediShield Life premiums or hospitalisations and cannot be withdrawn. However a minimum of 5000 will need to be set aside in MediSave to ensure there is sufficient MediSave for other medical expenses such as MediShield Life premiums or hospitalisations and cannot be withdrawn. However a minimum of 5000 will need to be set aside in MediSave to ensure there is sufficient MediSave for other medical expenses such as MediShield Life premiums or hospitalisations and cannot be withdrawn.

CareShield Life and MediSave Care. CareShield Life and MediSave Care. CareShield Life and MediSave Care. Benefits Auto Enroll into careshield life from 30-40 yo Born Between 1980 -. Benefits Auto Enroll into careshield life from 30-40 yo Born Between 1980 -. Benefits Auto Enroll into careshield life from 30-40 yo Born Between 1980 -. Medisave and Medishield Life can be used together to pay hospitalisation bills The difference is that Medishield life is designed to help pay larger B2C hospitalisation bills while Medisave for smaller ones. Medisave and Medishield Life can be used together to pay hospitalisation bills The difference is that Medishield life is designed to help pay larger B2C hospitalisation bills while Medisave for smaller ones. Medisave and Medishield Life can be used together to pay hospitalisation bills The difference is that Medishield life is designed to help pay larger B2C hospitalisation bills while Medisave for smaller ones.

This benefit is available for life data-reactid22Come 1 October well see the launch of two new healthcare schemes CareShield Life and MediSave Care designed to provide monthly cash payouts to Singaporeans aged 30 and above who suffer from severe disability or as long as they require long-term care. This benefit is available for life data-reactid22Come 1 October well see the launch of two new healthcare schemes CareShield Life and MediSave Care designed to provide monthly cash payouts to Singaporeans aged 30 and above who suffer from severe disability or as long as they require long-term care. This benefit is available for life data-reactid22Come 1 October well see the launch of two new healthcare schemes CareShield Life and MediSave Care designed to provide monthly cash payouts to Singaporeans aged 30 and above who suffer from severe disability or as long as they require long-term care. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. Enhance your Careshield Life payout by using Medisave. The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year.

The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year. The premium can be paid by Medisave with the cap of 600year. Of course you still can reap the benefits of Medishield life whichever ward class AB1 you choose to stay in or in a private hospital. Of course you still can reap the benefits of Medishield life whichever ward class AB1 you choose to stay in or in a private hospital. Of course you still can reap the benefits of Medishield life whichever ward class AB1 you choose to stay in or in a private hospital. Increase your payout from 600 to 2500 per month without cash top-up. Increase your payout from 600 to 2500 per month without cash top-up. Increase your payout from 600 to 2500 per month without cash top-up.

This figure is pretty close to the average. This figure is pretty close to the average. This figure is pretty close to the average. End of premium payment. End of premium payment. End of premium payment. The benefits are just pegged. The benefits are just pegged. The benefits are just pegged.

From 206 for men and 253 for women and will increase over time Estimated values Number of payments. From 206 for men and 253 for women and will increase over time Estimated values Number of payments. From 206 for men and 253 for women and will increase over time Estimated values Number of payments. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration. CareShield Life is an insurance scheme that provides financial support should SingaporeansSingapore PRs become severely disabled and need personal and medical care for a prolonged duration. Calling CareShield Life a bigger and better ElderShield isnt just hyperbole. Calling CareShield Life a bigger and better ElderShield isnt just hyperbole. Calling CareShield Life a bigger and better ElderShield isnt just hyperbole.

If you re searching for Careshield Life Medisave you've arrived at the right location. We have 20 graphics about careshield life medisave including images, pictures, photos, wallpapers, and much more. In such web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Why Careshield Life Is Good For You With 0 Monthly Payout

Source Image @ www.drwealth.com

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg

Source Image @ www.moneyline.sg

Careshield Life Singapore Home Facebook

Source Image @ www.facebook.com

Careshield Life Singapore Home Facebook

Source Image @ www.facebook.com